If you frequently deposit checks, having a "For Deposit Only" rubber stamp is a nice time-saver for endorsing them. Keep a kit or drawer set up with your checkbook, deposit slips, envelopes, a letter opener, pens, address labels, stamps, payment coupon books, a calculator, and a stapler. Step 5: Make bill-paying easier and more pleasant with organized supplies. Paperless billing options are great for reducing clutter, but make sure you have a good backup system for keeping bills electronically and that paperless notifications prompt you strongly enough to remember to pay them. You can often do draft or credit card agreements with your vendors, and your bank's online bill paying service typically can be set up with recurring rules. Automating payments means you can let go of worrying about important accounts like your mortgage. Step 4: Decide which bills you can automate and how.Įlectronic payments are faster than handwritten checks and easier to track down if there is a problem plus, you lessen the risk of identity theft if your outgoing mail is stolen with your checks inside. Set up a quick bill filing system with a simple brown accordion folder with tabs marked January – December, it's more efficient than having individually named vendor files.

#Organizing monthly bills to pay period how to

If you have multiple department store accounts and credit cards, consolidate them by figuring out how to use one or two of them to pay the others off, and stop using as many as you can. Step 3: Simplify your bills and your filing.

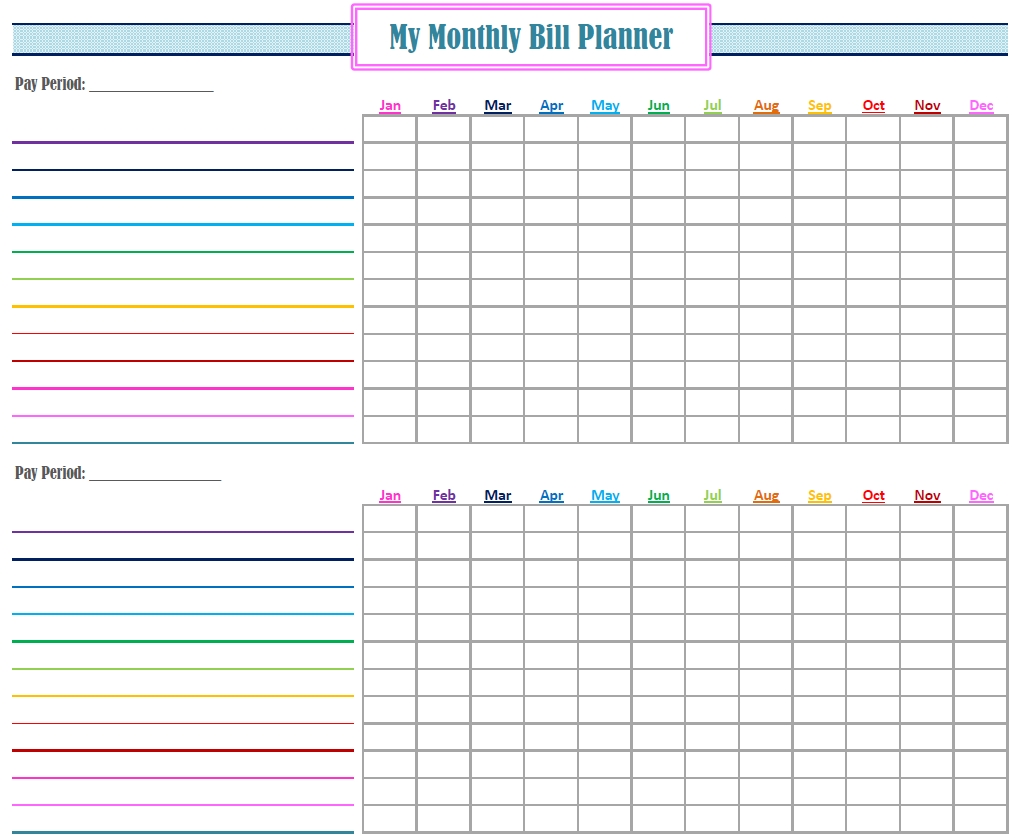

Intuit accepts no responsibility for the accuracy, legality, or content on these sites.Play icon The triangle icon that indicates to play Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. We provide third-party links as a convenience and for informational purposes only. I will also schedule new bills (that are paid online) at this period of time. If these bills need to be mailed then subtract 5 days to account for mailing time and to give you that buffer that you will need. In my weekly bill paying sessions I pay those bills whose due-date falls in that week. Readers should verify statements before relying on them. I use the printable monthly bill organizer to do this.

#Organizing monthly bills to pay period free

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Accordingly, the information provided should not be relied upon as a substitute for independent research. This next step relies on getting an accurate representation of all of your monthly expenses. does not have any responsibility for updating or revising any information presented herein. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality.

Additional information and exceptions may apply. Calendar gives you monthly view with payment statuses of bills. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Mark bill as paid from within notification without starting the app. An error in one cell can trigger a waterfall effect on your bookkeeping. Using a spreadsheet can also be time-consuming and potentially harmful. With a spreadsheet, you could run the risk of misplaced data, broken formulas, and lost files. While a spreadsheet is a good place to start, it may not be the most effective way to stay on top of your credit card payments, bank accounts and all the different types of business bills. Many small business owners want to get a better handle on organizing and paying their bills, but often they’re stuck using spreadsheets to log each monthly bill payment. You might come close to missing payments, getting hit with late fees-even dinging your credit score. Without an organized bill management system, your bills could quickly get lost in the shuffle. If you ever get into a situation where your bills pile up and you can’t keep up with due dates, it’s easy to get overwhelmed. Paying bills may not be the most exciting tasks for you as a small business owner, but it’s definitely one of the most important.

0 kommentar(er)

0 kommentar(er)